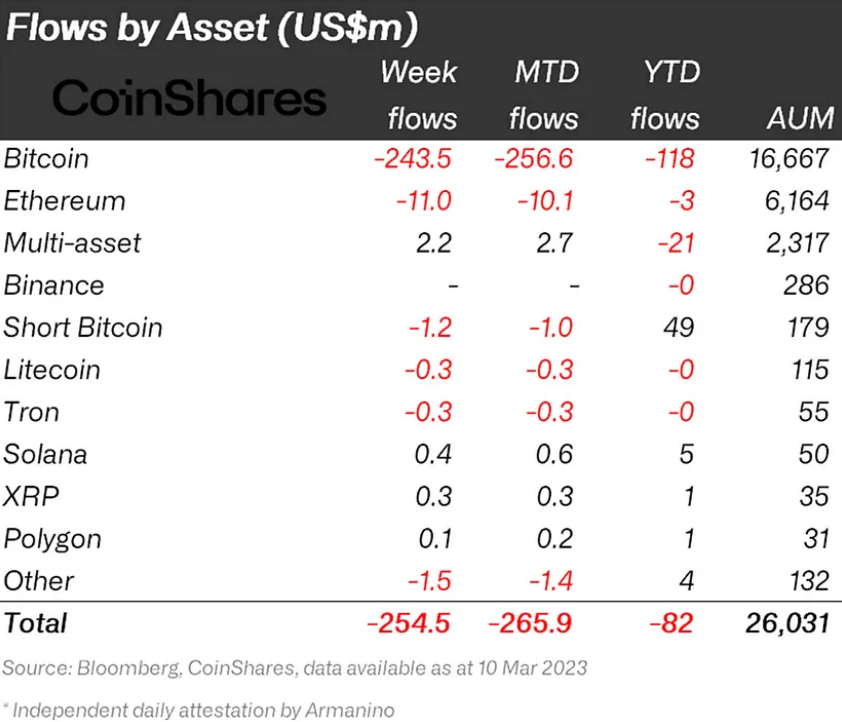

Digital asset investment products saw their highest-ever weekly outflow last week, according to the latest Digital Asset Fund Flows Weekly Report released by CoinShares. The $255 million in net outflows amounted to 1.0% of total assets under management (AuM) fleeing from the space.

Expressed in percentage terms of AuM, last week’s outflow represented the second largest exodus of capital from crypto after AuM dropped by 1.9% in one week back in May 2019. Back then, however, this amounted to just $52 million in outflows from digital asset investment products.

Bitcoin dominated outflows, with $243.5 million leaving long-Bitcoin investment products, while $1.2 million left short-products. Ethereum saw weekly outflows of $11 million. Altcoin net flows were close to neutral – Litecoin and Tron lost $0.3 million in capital, while Solana, XRP and Polygon gained $0.4, $0.3 and $0.1 million respectively. Other altcoins lost a new $1.5 million.

Last week’s outflows from crypto products wiped out net inflows for the year. Net flows now stand at -$82 million since the start of January.

Investors Dumped Crypto on Banking Concerns

Investors probably dumped their digital asset investments at such a rate last week due to concerns about a series of high-profile crypto-linked US bank failures, including Silvergate and SVB Financial. The failures of these banks triggered fears amongst investors of weakening fiat-to-crypto on-ramps and also about the collateralization of Circle’s USDC stablecoin, which had some reserves parked at these institutions.

Bitcoin at one-point last Friday had fallen all the way back to test its 200-Day Moving Average and Realized Price in the upper $19,000s. Investors were also likely fretting about the ongoing hawkish message from the Fed on the need for further interest rate hikes, as epitomized in a speech by Fed chair Jerome Powell earlier in the week.

And Missed a Face Ripping-Rally

However, the investors who dumped their crypto holdings have missed out on a face-ripping rally over the course of the past two days. Bitcoin was last trading in the low-$24,000s, up a stunning 24% versus last Friday’s lows.

The rally comes as 1) US authorities came in to rescue Silvergate and SVB depositors from any losses and introduced a new $25 billion liquidity program to help prevent further bank runs and 2) markets aggressively pull back on Fed tightening bets. The Fed can’t keep tightening with the US banking system on the verge of collapse, the thinking goes, especially given that its aggressive hiking campaign has been the chief driver of the vulnerabilities.

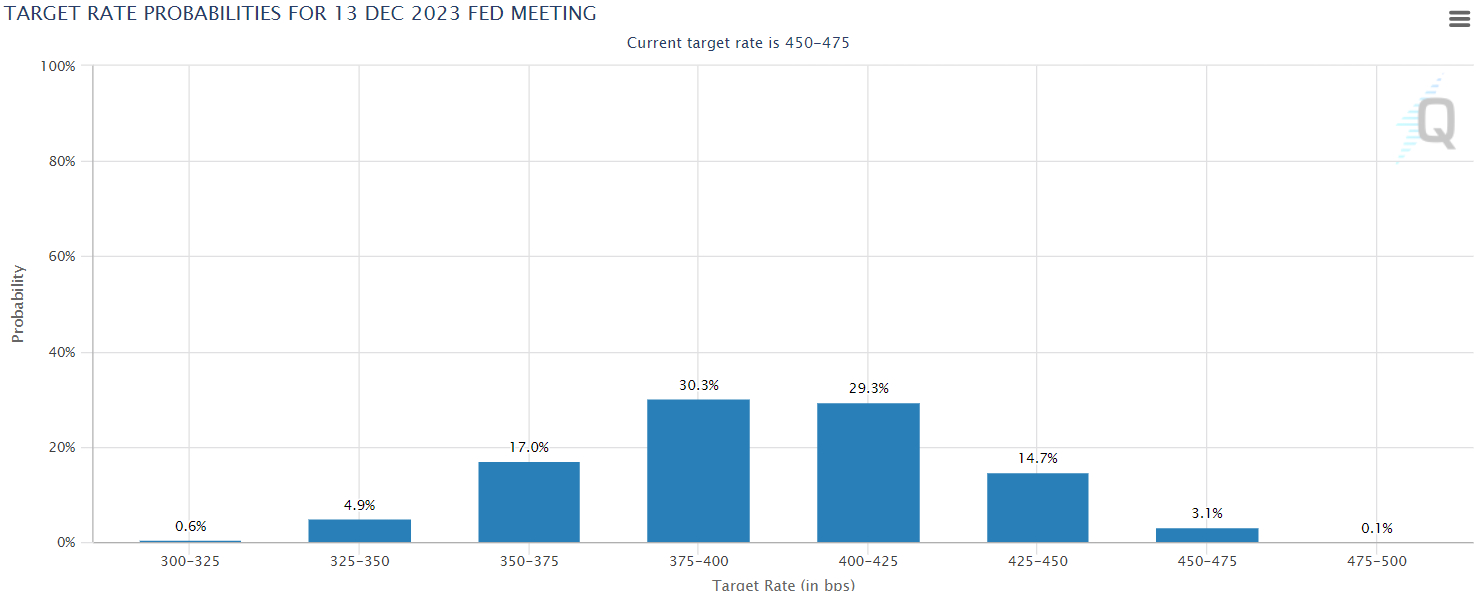

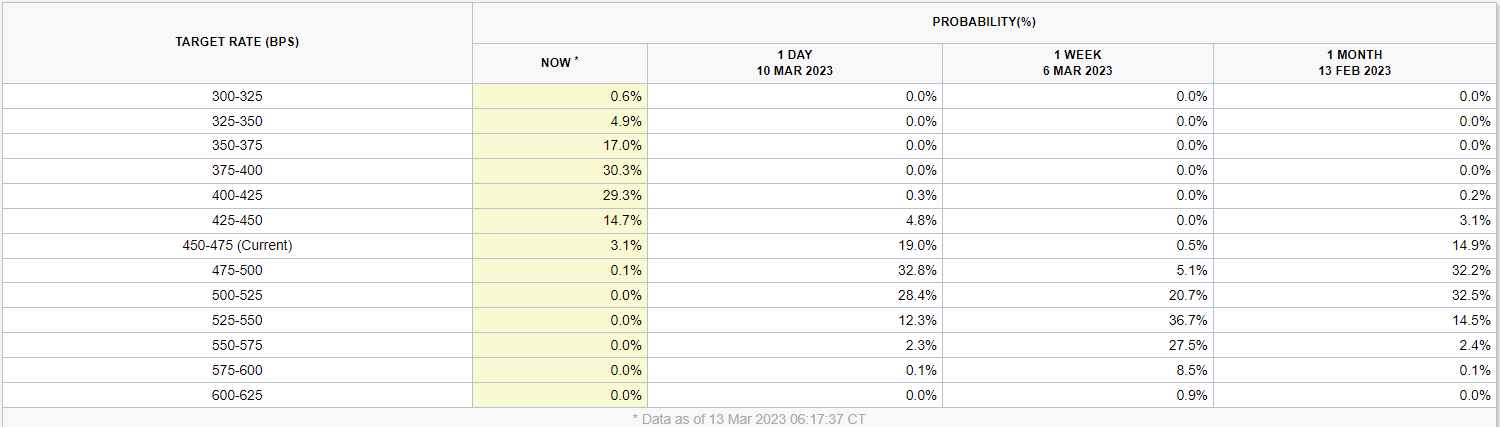

According to the CME’s Fed Watch Tool, markets only now assign a 65% chance that the Fed hikes interest rates by another 25 bps later this month. One week ago, markets were assigning a roughly 30% chance of a 50 bps rate hike later this month, and at least a 25 bps hike with absolute certainty.

Money markets then only assign a slim 32% chance of another 25 bps rate hike (to take rates to 5.0-5.25%) in May. By the end of 2023, money markets are now priced for US interest rates to have fallen back to around or just below 4.0%. This time last week, that pricing was skewed more towards rates ending the year in the mid-5.0% area.

The huge repricing in Fed tightening expectations has triggered a collapse in US bond yields, with the 2-year back to around 4.0% again, having been around 5.0% just days ago. The US dollar is understandably coming under pressure. This massive easing of financial conditions by US authorities to prevent a financial crisis is hugely bullish for crypto, as seen in the price action over the past two days.

By Joel Frank | Original Link