Todd Groth of CoinDesk Indices quizzes ChatGPT about crypto and then explores how that might factor into an investment opinion.

One of the perks of living in Los Angeles is the easy access to great hiking trails. Within 30 minutes (assuming you’re not trying during rush hour, which is key here) it’s possible to disconnect from La La Land on a canyon or ridge trail with only the occasional interruption from a fellow hiker and/or fitness influencer. Here, conversations can flow freely, punctuated with the occasional Google fact check when cell service allows.

“Do you think ChatGPT will replace your role?” I asked my data scientist friend, who works for a large tech firm in the midst of layoffs. “No, my job requires too much specific context,” she responded succinctly, acknowledging the protective barriers and moats created by proprietary corporate datasets.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Anyway, what does ChatGPT think about crypto – and does that thinking pose a threat to investment writers and strategists?

Let’s make an assumption: Its views ought to reflect the “average” opinion of the information and sentiment embedded in the data sources on which it was trained. The AI bot should give some sense of the consensus view on digital assets, a collective zeitgeist constructed from an advanced statistical exercise.

Or at least that’s the idea. I decided to find out what ChatGPT thinks.

Prompt: Explain bitcoin to a high school student.

ChatGPT: Bitcoin is a type of digital money that people can use to buy things online. But instead of being printed or minted like traditional money, it's made using computer code and stored on a public ledger called the blockchain.

Bitcoin is different from regular money because it's decentralized, meaning it's not controlled by any government or financial institution. Transactions are processed directly between users without the need for intermediaries like banks or credit card companies.

Because [b]itcoin is decentralized, it offers a level of privacy and security that traditional financial systems cannot match. However, its value can be volatile and there are risks associated with investing in it.

Overall, [b]itcoin represents a new way to transact and store value digitally, and is seen by some as a potential hedge against inflation or as a store of value like gold.

Decentralization, disintermediation, store of value, not controlled by any government, like gold – all common and consistent themes supporting the bitcoin narrative. Let’s keep going:

Prompt: Are cryptocurrencies useful? Please explain in simple terms.

ChatGPT: Cryptocurrencies can be useful for several reasons. Here are some of the most common:

Decentralization: Cryptocurrencies like [b]itcoin and [ether] are decentralized, meaning they are not controlled by any central authority or government. This can make transactions faster, cheaper and more secure.

Global access: Cryptocurrencies can be accessed and used by anyone with an internet connection, regardless of where they are in the world. This can be particularly useful for people who do not have access to traditional banking systems or for cross-border transactions.

Transparency: Cryptocurrency transactions are recorded on a public ledger called the blockchain, which means they are transparent and can be verified by anyone. This can increase trust and reduce the risk of fraud.

Programmability: Some cryptocurrencies like [ether] allow developers to create decentralized applications that can run on the blockchain. These applications can be used for a wide range of purposes, including finance, gaming, voting and supply chain management.

However, it is important to keep in mind that cryptocurrencies are still a relatively new technology and are subject to high volatility and regulatory uncertainty. Additionally, cryptocurrencies are not yet widely accepted as a form of payment and may not be suitable for everyone. As with any investment or financial decision, it is important to do your own research and consider your individual circumstances before investing in cryptocurrencies.

It sang a similar song of decentralization, disintermediation and transparency, albeit with an inclusion of smart contracts, a global perspective and a healthy financial risk disclaimer. It’s useful to remember that ChatGPT’s training data included information up until September 2021, coincidentally around the peak of the last bull market. A quick prompt of “What is FTX and who is Sam Bankman-Fried?” confirms a lack of awareness of, well, you know what happened a few months ago.

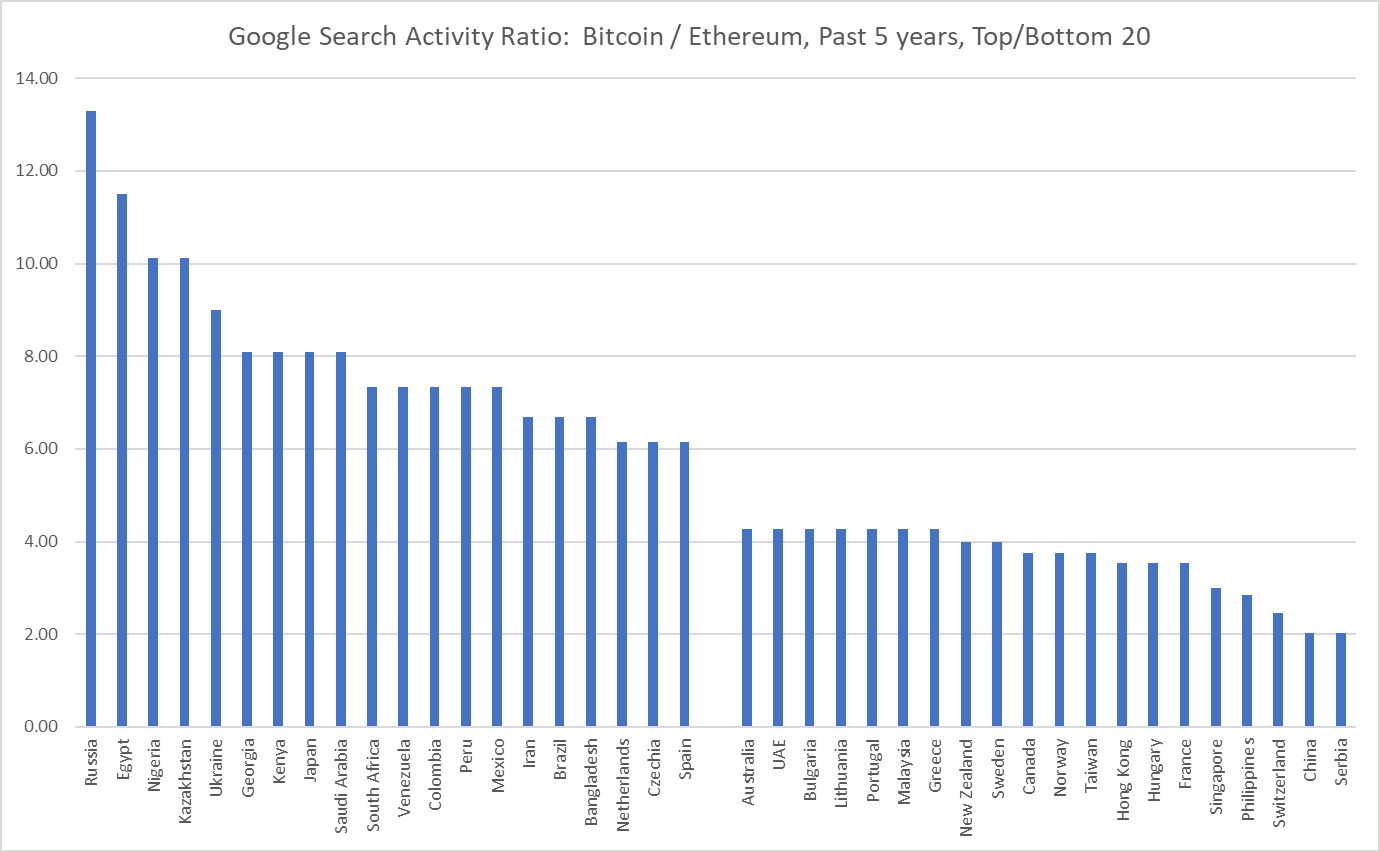

ChatGPT’s reference to the global nature of cryptocurrencies is a good reminder that digital assets make it easier to make cross-border remittance payments and provide a decentralized and trusted open-source alternative for regional or local financial services and infrastructure. It’s all too easy to overlook these critical use cases, because people like me mostly take them for granted as part of modern life in a developed economy, absent the infrequent banking crisis. Preference for this more banal use case can clearly be seen when comparing Google Trend search data for Bitcoin versus Ethereum (see below).

Here, the search activity for Bitcoin and Ethereum have been combined to create a relative ratio of activity, with the intent to proxy user interest. A value of 1 would suggest an equal amount of search activity within a country is spread across Bitcoin and Ethereum; 10 means 10 times more searches for Bitcoin than Ethereum. Given that BTC currently has about 2.3 times more market capitalization than ETH, it’s not surprising that no ratio in the chart above is much below that number. Switzerland at 2.3 is neutral (as usual), aka in line with market cap expectations.

Russia, Egypt and Nigeria show substantially more interest in bitcoin over ether, while Serbia, China and Switzerland (the Ethereum Foundation is based in Switzerland) are relatively more interested in Ethereum. From a glance at the countries within the top and bottom of bitcoin/ether search activity bins, we could conclude that developing and frontier economies are more focused on store of value and decentralized payment system utilities, whereas developed economies are more interested in refining and upgrading existing financial technology infrastructure via blockchain rails and smart contract platforms.

By Todd Groth, Nick Baker | Original Link