ALSO: Former CoinDesk head of research Noelle Acheson writes that longer-term narratives such as bitcoin's recent store-of-value story matter but that price depends more on fleeting, often fickle sentiment.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3QMQHWCX2BFFZKIFM2P7MJ4YMU.jpg)

Good morning. Here’s what’s happening:

Prices: Bitcoin regained its perch above $30K, but its rally stalled; ether hovers near $2,100.

Insights: Longer-term narratives, such as bitcoin's recent store-of-value story matter but price depends on traders' shorter-range, often fickle sentiments.

Crypto markets started promisingly on Tuesday with bitcoin re-establishing its foothold above the psychologically important $30,000 threshold.

But the BTC rally stalled around $30,300 by midday, and the largest cryptocurrency was up just 3.3% over the past 24 hours. Bitcoin had dipped as low as about $29,100 on Monday before rebounding, as investors seemed to regain some of their prior zest for assets that hold value even as concerns about the banking industry have faded.

In an interview with CoinDesk TV's "First Mover" program, Kaiko senior research analyst Dessislava Aubert called the current rally "macro driven and said that its ongoing strength would depend on liquidity.

The rally "started with the Fed (U.S. Federal Reserve) providing emergency liquidity to banks in the United States," Aubert said. "So definitely, liquidity is playing a huge role."

She added: "We have seen that markets are expecting great cuts in the second half of the year. So there is still a lot of uncertainty around whether this will be the case or not. Ultimately, it will depend on how U.S. monetary policy turns out."

Ether climbed above $2,100 for the second time in three days before dipping below the threshold and then rising again. The second largest crypto by market capitalization was recently changing hands at about $2,100, up about 1.5%. A post Ethereum Shanghai upgrade sell-off has yet to materialize.

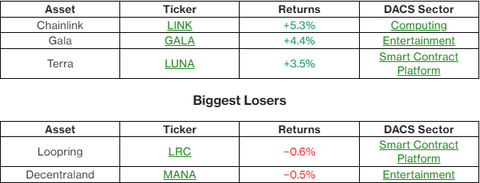

Other major cryptos were solidly green with ICP, the token of blockchain-based, smart contracts platform Internet Computer, recently rising 15% to trade at about $6.80. XRP, the native crypto of the blockchain-based, payments-focused platform XRP ledger, was up more than 3%. The CoinDesk Market Index, which measures the performance of the overall crypto market, was recently up 2.7% and in significant uptrend territory on a one to five scale.

Equity indexes spent the day largely running in place as the Dow Jones Industrial Average (DJIA), tech-heavy Nasdaq Composite and S&P 500 were all within a few fractions of a percentage point of where they stood at the close of trading Monday. Gold ticked upward to $2,017, but was still down from its near record highs of last week when assets that held value were in vogue. The yield on 2- and 10-year Treasury edged up slightly but last week's surge has stalled.

In an email to CoinDesk, Anthony Georgiades, co-founder of Pastel Network, a decentralized blockchain for non-fungible tokens (NFT), cryptos and Web3 technology, attributed bitcoin's plunge under $30,000 to "converging elements," particularly the looming prospect of an inflation-focused Fed continuing its diet of hawkish interest rate hikes. But he also noted a loss of public confidence in the dollar and banking system.

"People...are seeking a decentralized safe haven asset that is an inflation hedge," he said.

He added: "There are also macroeconomic conditions to consider. With an easing CPI and recessionary signals, the market seems to be pricing in potentially dovish Fed policies, which could lead to a risk-on craze. Bitcoin has found itself in somewhat of a paradoxical environment, and there may be price fluctuation to weather until the Fed’s short and medium-term monetary policies become clearer."

Insights

Bitcoin’s 'Store-of-Value' Narrative Is Real but Not a Price Mover

Markets are noisy, chaotic things that we human beings instinctively try to imbue with order and reason. This generally involves searching for explanations as to why prices are trending up or down or what triggered a sharp move.

Often there is an obvious explanation – an earnings surprise or an unexpected corporate action. Sometimes the cause isn't so easy to see – flows of funds, an evolving user base, steady product development and so on.

Noelle Acheson is the former head of research at CoinDesk and Genesis Trading. This article is excerpted from her Crypto Is Macro Now newsletter, which focuses on the overlap between the shifting crypto and macro landscapes. These opinions are hers, and nothing she writes should be taken as investment advice.

With bitcoin (BTC), it’s even harder to discern what is driving sentiment shifts at any given time because it doesn’t have earnings, there are no corporate actions, regulation isn’t the threat it is for some other crypto assets and the narratives are multiple and varied. There isn’t even universal agreement as to what bitcoin is, let alone what drives its price.

But our search for reason amid chaos encourages us to latch on to something that makes sense, and if it is a narrative that justifies our interest while highlighting a timely concept, then so much the better.

Store of value

One phrase we’re hearing a lot of these days is “store of value.” It tends to mean different things to different people, but in general, it refers to an asset that holds its value relative to a broad basket of other assets over a long stretch of time.

In spite of its short-term price volatility and sharp bear markets, bitcoin is a store of value because it is the only asset traded on liquid exchanges today with a programmatic and verifiable hard cap. With other “hard assets” (those with limited supply) such as gold, diamonds or real estate, we don’t know the supply cap, nor do we know how much is currently in existence.

Plus, with other “hard assets,” the price influences the potential supply. For instance, if gold were to surge from $2,000 to $20,000 per ounce, new extraction methods would become viable, boosting the theoretical cap. Bitcoin is the only asset traded on liquid exchanges for which the price has no influence whatsoever on the supply. It is the hardest of hard assets.

What’s more, the supply of its most common denominator – the U.S. dollar – has been increasing over the decades, and more recently at an astonishing pace. We are likely about to embark on another wave of monetary easing, involving lower interest rates and the incentivization of credit to overcome declining economic growth and consumption.

An increase in the supply of USD above what economic growth can absorb will – all other things being equal – decrease its value relative to other assets, and following basic math, if the value of the denominator drops, that of the ratio increases. Bitcoin is a store of value and a hedge against currency debasement.

By James Rubin | Original Link