Ethereum regained investor support on Monday after slumping in recent days.

For the past month, crypto markets have been buffeted by speculation over the potential impact of Ethereum's (ETH) coming Merge – a major milestone for the second-largest blockchain. A key question is how the shift to a proof-of-stake system, which is supposed to be faster and more energy-efficient than the current proof-of-work protocol, will affect prices for ether and related digital assets.

And with the event now approaching, expected next month, the market narrative keeps twisting.

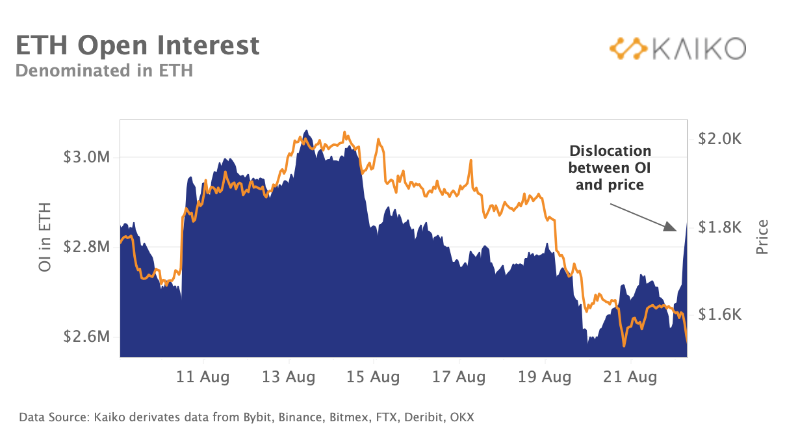

According to a weekly report from the data provider Kaiko, ether’s steep price plunge on Friday brought a swift decline in open interest on derivatives – contracts that traders used to make leveraged bets on the cryptocurrency’s future price. Many traders had their derivatives trades liquidated, or wiped out due to margin calls, according to Kaiko.

But on Monday, money flooded back into the ETH futures market, the data provider found.

“As the price dipped below $1,600, we observed a significant spike in open interest,” Kaiko wrote.

Open interest in ether derivatives spiked on Monday, just days after a price crash. (Kaiko)

Ether perpetual funding rates

There’s also been plenty of movement in funding rates on ether perpetual contracts, which are similar to futures contracts on commodities but without expiration dates. The funding rates recovered to near-neutral levels after dipping alongside the token’s price.

“When combined with the spike in open interest we observed this morning, it seems these new positions in ETH futures are biased long and investors are bullish at these price levels,” Kaiko wrote.

Trading volumes flipped

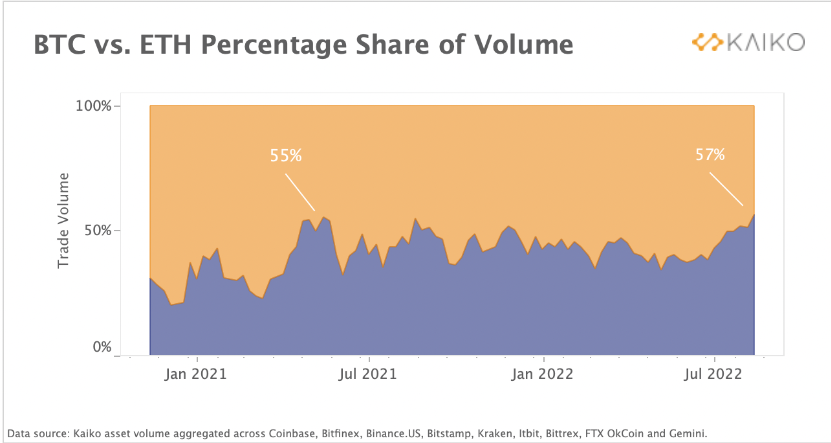

Ethereum’s percentage share of volume broke above its previous high of 55% in May 2021. (Kaiko)

Separately, ether’s share of the weekly, combined trading volume of ether and bitcoin hit 57%, the highest since 2018. This trading activity exceeded Ethereum’s previous peak of 55% during the May 2021 crypto sell-off.

“The main driver of ETH trading activity in July has been increased optimism around the Merge and an improvement of global risk sentiment. However, last week’s selloff across markets confirms that ETH remains a higher beta play,” Kaiko wrote.

Proof-of-work Ethereum fork?

There’s ample speculation that many Ethereum miners might try to keep supporting a proof-of-work, which the blockchain currently uses, similar to Bitcoin’s. Ethereum Classic (ETC) and ETHPOW – based on a new, theoretical fork that might take place – have been touted as possible choices as the Merge approaches.

According to Kaiko, Ethereum Classic has outperformed other forks, such as Bitcoin Cash, as well as ETH and BTC year to date. However, the token recently retraced gains, falling over 20% over the past week.

ETHPOW’s price, meanwhile, has fallen over 60% from a high of $140 at the beginning of August to around $50. The token’s daily volume dropped 66% after its first week going live, as traders’ appetites fizzled out.

ETHPOW’s price has fallen over 60% from its early August high. (Coinmarketcap)

While some Ethereum Merge concerns such as further delays, an unsuccessful transition and proof-of-work fork competitors remain amongst traders, Arca Research Analyst Nick Hotz says that most of them are overblown.

“Three Ethereum testnets (Ropsten, Sepolia, and Goerli) and nine ’shadow forks’ have merged successfully,” Hotz wrote. “Many of the hiccups seen in testing arose from the fact that these tests were not the real thing, whereas the actual Ethereum merge probably would have gone smoothly.”

Once Ethereum reaches a specific total terminal difficulty (TTD), or amount of computing power dedicated to the network, the Merge will happen. Right now, the Merge is estimated to be around Sep. 15.

“When the TTD is reached, Ethereum will switch to proof of stake, regardless of any hiccups,” Hotz wrote.